Table of Contents

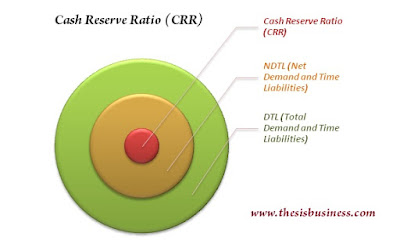

Cash Reserve Ratio (CRR):

“Cash Reserve Ratio (CRR) refers to the certain proportion of Net Demand and Time Liability (NDTL) of the commercial banks which has to be reserved in the form of cash (liquid asset) under the supervision of RBI as per Section 42 of the RBI Act”

In other words, RBI has mandated that every commercial bank must keep a specific part of its net deposits in form of cash to avoid the shortage of cash and to control the supply of money in the economy.

The value of CRR is 4% right now however it can be adjusted any time by RBI. In case any commercial bank defaults to maintain CRR a penalty of 3% above Bank Rate will be imposed. Also, this penalty will be increased to 5% above Bank Rate if the banks will continue defaulting succeeding working days.

DTL and NDTL:

NDTL refers to the net cash available in a bank for the distribution of credit to its customers, this means total cash deposits of commercial banks excluding banker cheques, other bank’s deposits, subsidy etc.

DTL (Demand and Time Liabilities) is the total deposits (Liabilities) such as saving account deposits, current account deposits, time deposits (fixed deposits) and recurring deposits during the specified time period.

Objectives of Cash Reserve Ratio:

CRR is one of the most important components of the monetary policy of the Reserve Bank of India. The main objectives of CRR are as follows.

- CRR control the supply of money in the market.

- CRR facilitates to avoid the circumstances of a cash crunch.

- CRR facilitates in maintaining the rate of inflation in the economy.

How does Cash Reserve Ratio work?

Suppose State Bank of India has Net Demand and Time Liabilities is Rs 1000 crores and CRR is 4% which is mandated by RBI. Therefore, Rs 40 crores will be reserved in the form of cash with RBI and hence Rs 960 crore is available for the disbursement of loans.

Now if RBI needs to increase the supply of money in the market, it reduces the cash reserve ratio. Therefore, the amount of distributable cash will be more and thus it leads to a higher rate of inflation.

Conversely, if RBI needs to decrease the inflation rate in the country, simply it would increase the cash reserve ratio. Therefore, the creditable cash will be less and it decreases the supply of money in the market. Thus the rate of inflation goes down.

In this way, RBI regulates the supply of money and hence control the rate of inflation in India.

Cash Reserve Ratio vs Statutory Liquid Ratio:

Although both CRR and SLR are regulated by the Reserve Bank of India and have the same objective yet there are few differences between them.

- CRR is regulated under section 42 of the RBI Act 1934 whereas SLR is regulated by the Banking Regulation Act.

- CRR has to maintain in form of cash only whereas SLR could be maintained in the form of gold, RBI approved securities and cash as well.

- In the case of CRR, commercial banks neither get interested nor may invest in the financial market, on the other hand in case of SLR commercial banks do earn incentives as well.

- The main objective of CRR is to control inflation and to protect from cash crunch whereas Statutory liquidity ratio’s objective is to control the bank’s leverage.

Related Terms: