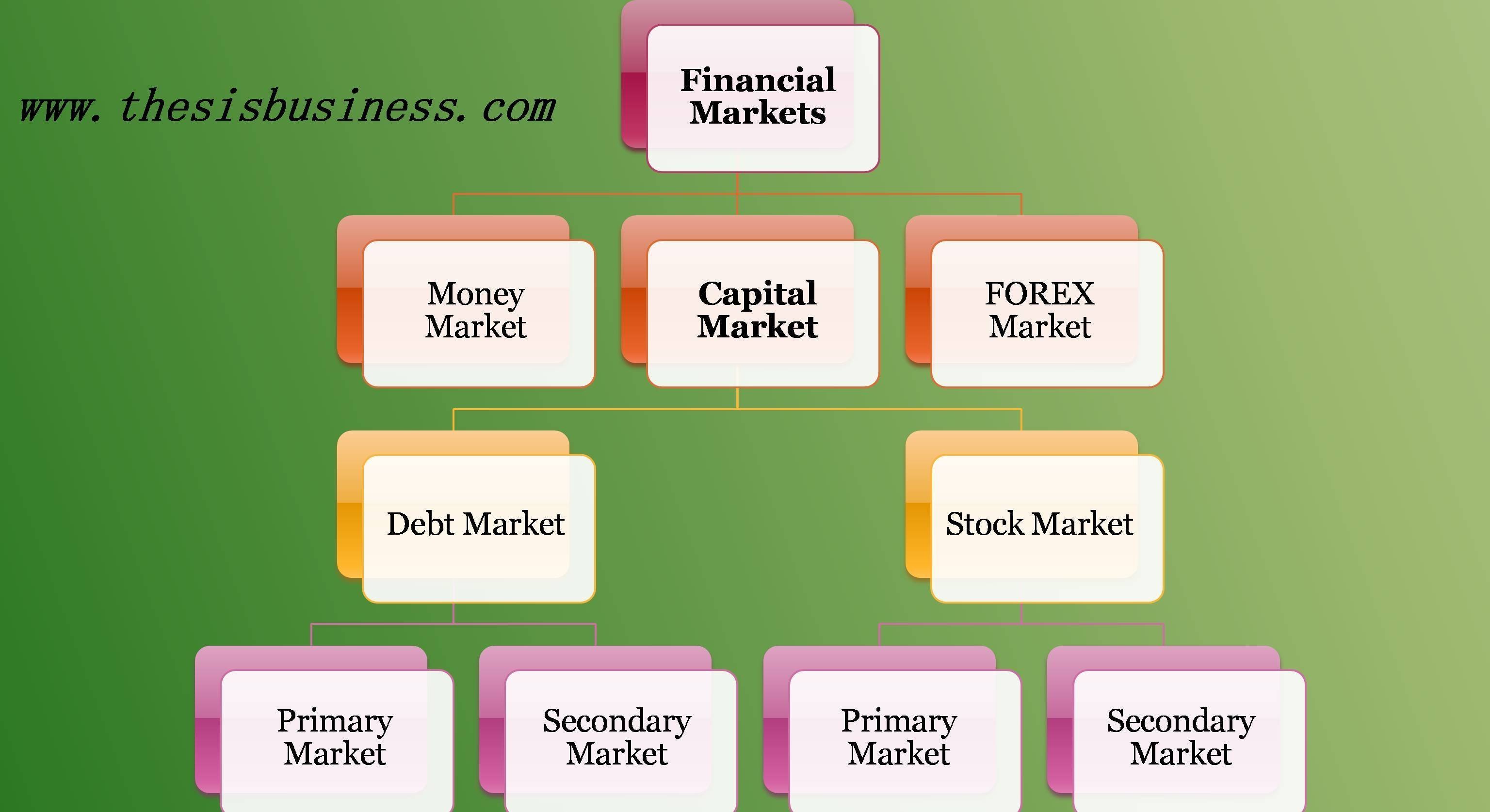

The companies or government entities fulfil their short term requirement of funds through the money market whereas they raise funds from the capital market to meet their long-term needs. The financial market is classified into three categories viz Money market, Capital market and Forex market.

Further, the capital market can be divided into the Stock Market and Debt market. Now the stock market, as well as Debt market, can be classified into Primary market and secondary market.

See the following figure to understand the hierarchy of the financial markets in the economy.

In this article, we will understand the major differences between Primary market and Secondary market. Now let us conduct a detailed comparison between Primary and Secondary Market.

Read Also, Functions of Financial Market

Table of Contents

Primary Market and Secondary Market:

A Primary market is a marketplace where new securities such as government bonds, corporate bonds, commercial papers, treasury bills, debentures and shares are created or first time issued to the general public to buy, on the other hand, in the secondary market the securities which are created in the primary market are traded (sold and brought) among the different anonymous investors.

The companies or government entities issue new securities for sale to the general investor through an Initial Public Offer (IPO) while these securities can be sold or purchased in the secondary market after completion of IPO process.

Hence we can say that the primary market is responsible for the origination of securities, on the other hand, the secondary market is responsible for the advertising, marketing, sale and purchase of existing securities to provide liquidity in such securities.

Primary Market vs Secondary Market:

| BASIS OF COMPARISON | PRIMARY MARKET | SECONADRY MARKET |

|---|---|---|

| Meaning | It is the marketplace in which new securities are created and issue to the investors. | It is the marketplace where existing securities are advertize, marketize and traded among the investors. |

| Types of Instruments | Initial Public Offer (IPO) and Further Public Offer (FPO) | Mainly Shares, Bonds and Derivatives |

| Benificiery | Company (Issuer) | Investors |

| Frequency of Purchase or sale | Only Once | Infinite |

| Intermediary | Underwriters such as investment bankers | Brokers |

| Trading is done | Between issuer and investors | Among Investors |

| Price of Securities | Fixed | Varriable |

| Main Functions | Creation, Underwriting and Distribution of new securities. | Advertisement, Marketing and Trading of listed securities. |

| Data and analytics | Less data and analysis available to decide whether to invest in an IPO or not. | A detailed data and records available for investors to analyse whether to buy a security or not. |

| Existence | No organisational and geographical presence | Geographical and organisational setup exists (eg. BSE, NSE, NYSE) etc) |

Difference between Primary Market and Secondary Market:

We can distinguish primary market from the secondary market based on its functions, features, role and outcomes etc which are discussed below in details.

- The primary market is also known as the New Issue Market as the new securities are formulated in this market whereas the secondary market typically known as the stock market in which several existing securities like stocks, bonds, treasury bills, commercial papers, derivatives are traded among the different individual investors.

- The main functions of the primary market are origination, underwriting and distribution of new securities, on the other hand, the major functions of the secondary market are advertisement, marketing and trading of already issued (listed) securities.

- The price of new securities in the primary market is determined by the issuer/ company, however, prices of securities are determined by the market (secondary) itself depending on the supply and demand of the respective security.

- The role of intermediary between the issuer and investors is assigned to investment bankers in the primary market, on the other hand, brokers and primary dealers play the role of middleman in the secondary market, in other words, the investors sell or buy the securities like equity shares or bonds with the help of a broker.

- The investors buy the securities directly from the company in the primary market while in the secondary market investors buy the securities among themselves.

- In the primary market, there is less data, analytics and records available regarding IPO or FPO to judge the securities whereas in case of the secondary market a detailed data and previous performance records are available to predict the securities’ profitability.

- In the primary market, the fundraised from the purchase of securities by the investors is the gain of the issuer (company or government entity), on the other hand, the capital gain due to price fluctuation and trading of securities in the secondary market is of the investor who sells the security.

- The prices of securities are fixed in the primary market whereas the securities’ prices are fluctuating due to demand and supply in a particular security.

- In the primary market, the securities are sold or purchased only once whereas the securities (debt or equity) can be sold or purchased multiple (infinite) times.

- The primary market doesn’t have any physical location and organizational setup, however, the secondary market has the geographical existence in some locale.

- All in all, we can say that the primary market facilitates the various organisations in arranging the long term capital from the public through an IPO, FPO, Right Issue, Private Placement etc, on the other hand, the secondary market facilitates the investors anytime for the mobilization and liquidation of their saving and investment respectively.

Conclusion:

Hope you have understood the difference between Primary market and Secondary market. In a nutshell or to understand more clearly, suppose if a company need to arrange funds, then the company will go in the primary market to float/ sell new securities (it could be shares or debentures) to the public.

Contrary, the secondary market provides liquidity (can be easily and anytime sold to other investors) to such securities which are issued in the primary market before. It encourages investors to invest their funds in IPOs and other securities because they can be sold these securities whenever they wish.

Recommended Articles:

Preference Shares | Pros and Cons

Government Securities in India

References: 1) Investopedia, 2) Karvyonline