Working capital is the basic requirement of any company for its operation or expansion whether it is public or private, and raising funds from the general public is one of the most popular ways to arrange finance. The companies or government entities raise capital by issuing securities to the investors.

The investors purchase those securities to invest their money to make returns which could be in the form of dividend or interest. Thus the issuing organisations meet their requirement of funds.

You would be thinking where these procedures are accomplished. So it is the Primary Market where all these sales and purchase of securities between issuer and investors are done. In this topic, we will understand the Primary Market in details.

Table of Contents

Primary Market:

“Primary Market, also known as New Issue Market is the marketplace where the corporations or government entities first time sell the securities to the general public/ investors to raise capital and on the other hand, the investors buy those securities to mobilise their funds to earn a profit.”

The securities which are issued in the primary market for the first time could be debt instruments like government bonds, corporate bonds, debentures or Equity Shares of the companies. The primary market is regulated and governed by the Securities and Exchange Board of India (SEBI).

There are mainly three parties involved in the primary market during the issuance of new securities: The company/ issuer, underwriter and investors. The company which issues new securities, the underwriter who is responsible to determine the price of securities and evaluation of whole issuance process and lastly the investors who actually buy these securities.

Read Also, Difference between Debt and Equity Funds

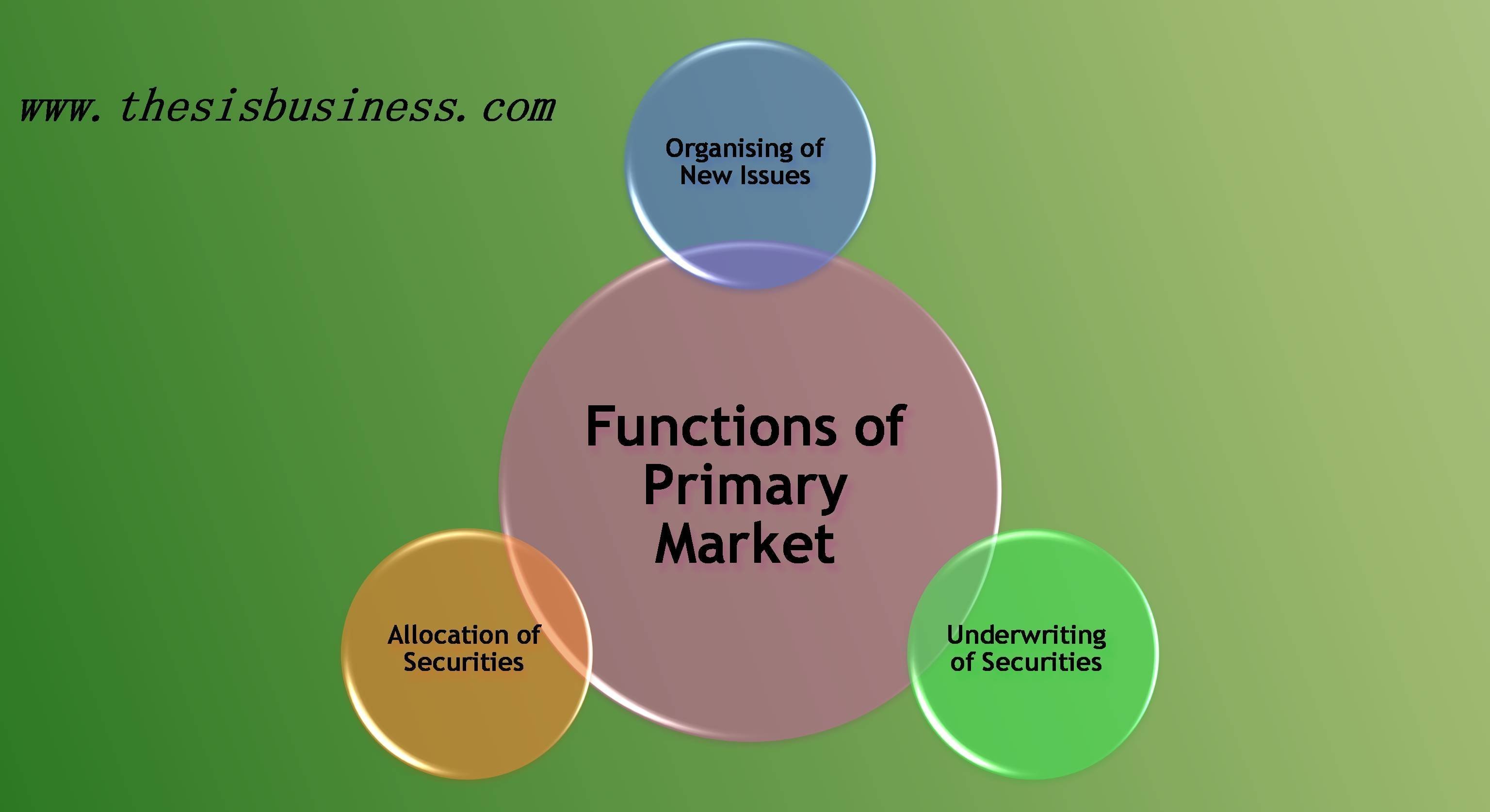

Functions of Primary market:

There are three main functions of the primary market:

- Organising of New Issues

- Underwriting of Securities

- Allocation of Securities

Organising of New Issues:

The primary market organises the process of issuing the new securities such as government bonds, corporate bonds, debentures, commercial bills and stocks of companies prior to the actual sale of these securities in the market. The issuing process includes investigation, analysis and assessment of new issues such as financial, legal, technical and regulatory viability of the project. The analysis also includes the pricing, method and types of new securities which ensures the success of new issues in future.

Underwriting of Securities:

Underwriting is one of the significant aspects when it comes to issuing new security in the market. There are various financial institutions such as merchant banks and investment banks or other private firms which provides underwriting services for the corporate or government bodies. These financial institutions make a bridge between issuer and investor which ensure better implementation of issuance of new securities.

Such institutions are also responsible to ensure maximum subscription of new issue otherwise they buy the remaining unsubscribed securities and further resell these securities to the real investors. These financial institutions have professionals who are expert in dealing with underwriting services. Therefore, the companies hire merchant bankers or investment banker for hassle-free issuance of new issues and to hedge the risk of unsold securities.

Allocation of Securities:

The new securities are sold to investors in the primary market. There are various dealers and breaker which are responsible for marketing and advertising of new issue. Distribution is the final and most crucial step of the issuing process of securities. Thus the primary market also facilitates the allocation of new securities.

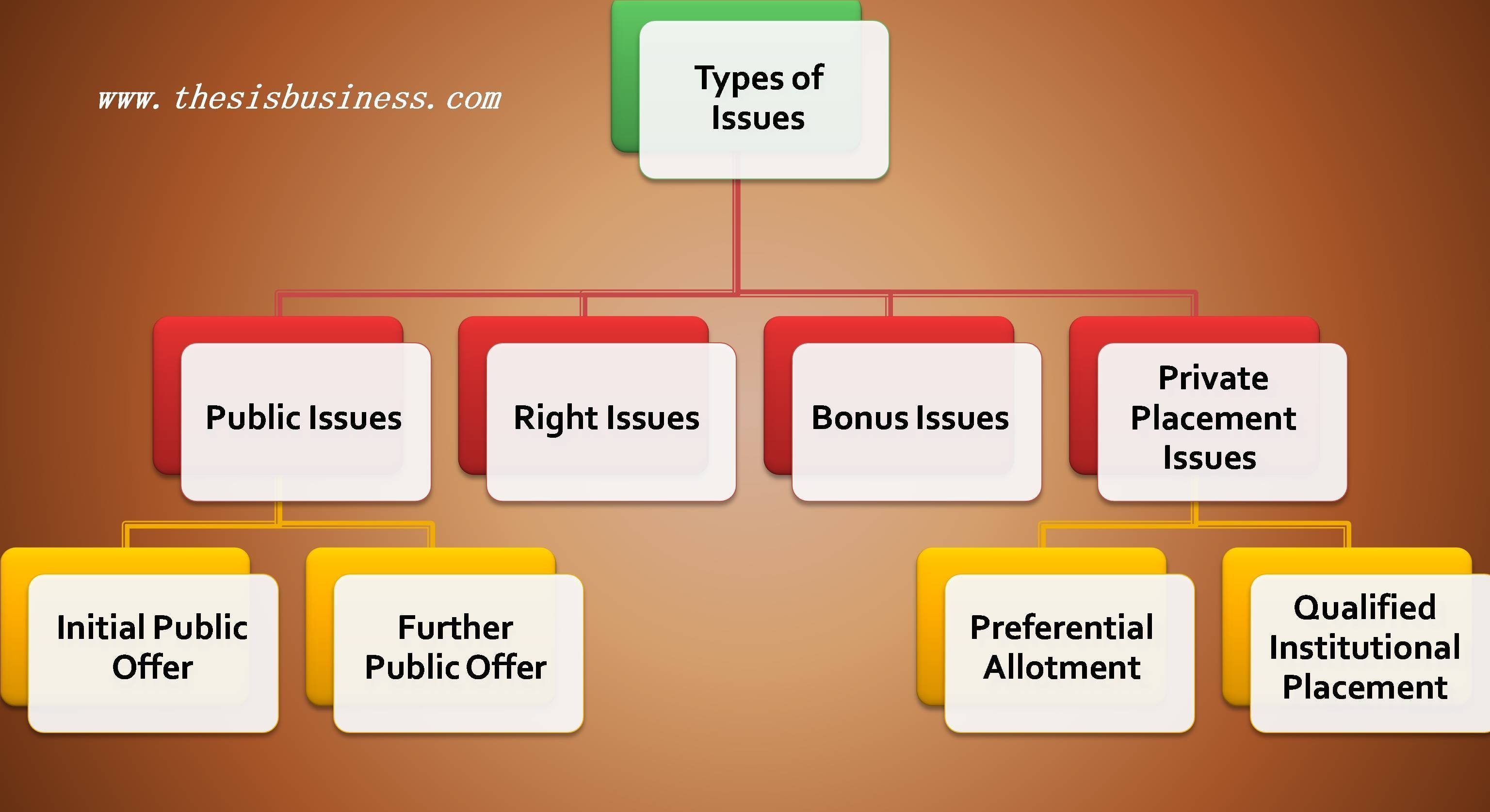

Types of Issues in Primary Market:

A company can issue the securities in the following ways.

- Public Issues

- Right Issues

- Bonus Issues

- Private Placement Issues

1) Public Issues:

When a company or government organization issues/ offer the securities to new investors to become a shareholder of the company is called a Public Issue.

The public issue can be further classified into:

Initial public offer (IPO):

When a company which is not listed in the stock exchange offer fresh or existing securities or both for first time sale to the general public, it is known as an Initial Public Offer (IPO). This is the process of listing and trading the securities of any company in the stock exchange.

Further public offer (FPO):

When a company which is already listed in the stock exchange issues/sells its fresh securities to the investors will be known as FPO.

2) Right Issues:

When a company issues the securities only for its existing shareholders who hold a specific number of shares on a specific date (Record Date) declared by the issuer, such types of issues are known as Right Issue.

In other words, If an issuer offers the securities for sale to its existing shareholders but the condition is that shareholders must hold a specified number of shares on a specified date which is announced by the issuer itself.

3) Bonus Issues:

Sometimes the companies announce bonus shares instead of dividend to their shareholders for the particular financial year. Such issues of bonus shares are called Bonus Issues. In other words, when a company issues the securities to its existing shareholders provided as on a record date without any other conditions, it is known as bonus issues.

The bonus shares are issued as per a particular ratio (1:1, 1:2 or 1:3 etc) as on record date. It is a free reward of the company to its shareholders.

4) Private Placement Issues:

When any company or government entity makes an issue of their securities to a specified group of investors, it is called a private placement. Moreover, the issue should be neither right issue nor public issue and the investors could be the individual investors or institutional investors. A private placement is much easier than the initial public offerings due to lesser regulatory formalities.

Private placement of shares or convertible securities by an issuer can be of two types:

Preferential Allotment:

When a listed issuer issues equity shares or the securities which are convertible to equity shares, to a specified group of individuals, it is called a preferential allotment.

The issuer is required to comply with various provisions which inter-alia include pricing, disclosures in the notice, lock-in etc, in addition to the requirements specified in the Companies Act, 2013.

Qualified Institutional Placement (QIP):

When a listed company issues equity shares or other securities other than warrants which are convertible into equity shares like fully or partially convertible debentures to an especial set of institutions are called Qualified Institutional Placement.

The companies issue the securities to these Qualified Institutions Buyers for which such securities are convertible into equity shares. The qualified institutional buyers are those institutions which are expert to drive and evaluate the stock market. Some example of Qualified Institutional Investors are:

- Scheduled Commercial banks

- Mutual Funds

- Foreign Institutional Investors (Registered with SEBI)

- Insurance Companies

- Pension Funds etc.

Features of Primary Market:

- Unlike the secondary market, there is no risk of loss due to price fluctuation in the primary market. The prices of securities are decided prior to an initial public offering (IPO).

- The chances of manipulation in the price of securities are comparatively less than the secondary market. Therefore, a fair and transparent process of new issues is performed in the primary market.

- The new issues floated in the primary market provided high liquidity as it can be easily sold in the secondary market.

- The primary market is an important source of investment for the investor at a reasonable price as it is not influenced by the other manipulators in the market.

- The primary market also facilitates the investors to diversify their savings into various other types of instruments and different industries as well.

Conclusion:

Hope this article would be able to explain the meaning and functions of the primary market. In a nutshell, from investors’ point of view a primary market is the market for the trading of new securities, on the other hand, from the company perspective, it the marketplace through which an organisation can raise funds from the general public by issuing new securities to the investors.

Recommended Articles:

Investment Banking vs Merchant Banking

Preference Shares | Pros and Cons

References: 1) Groww.in 2) Wikipedia primary market