The corporations, government entities or other financial institutions raise funds to fulfil their requirements of money through issuing/ selling securities to the general public. These securities can be equity or debt securities which the general investors buy for the sake of returns on their investments.

One link is missing in the whole process that is a ‘marketplace’ where these securities are traded (brought or sold) between issuer and buyers.

Hence in this article, we will learn about the capital market, capital market instruments, functions of the capital market and much more.

Table of Contents

Capital Market:

As we explained above the corporations fulfil their long term requirements of money by selling securities to the general public/ investors. The capital market is sometimes known as the stock market or stock exchange refers to the marketplace (or medium) where long term securities having maturity period more than one year are created/ sold by the companies or government and brought by the investors.

Capital market also allows/ facilitates to buy or sell the existing securities among various (anonymous) investors.

The capital market in India is regulated under the Securities and Exchange Board of India (SEBI). It establishes a bridge between investors and companies for mobilisation of savings and better utilisation of surplus funds for economic growth and development.

The capital market can be classified into two types.

- Primary Market

- Secondary Market

The primary market is the marketplace where the securities are created/ issued by the issuer for the first time to the general public.

Whereas, Secondary market refers to the market where the already issued securities are bought and sold among the investors. The secondary market could be divided into two segments.

- Spot Market

- Future Market

See Also, Difference between Primary Market and Secondary Market

Capital Market Instruments:

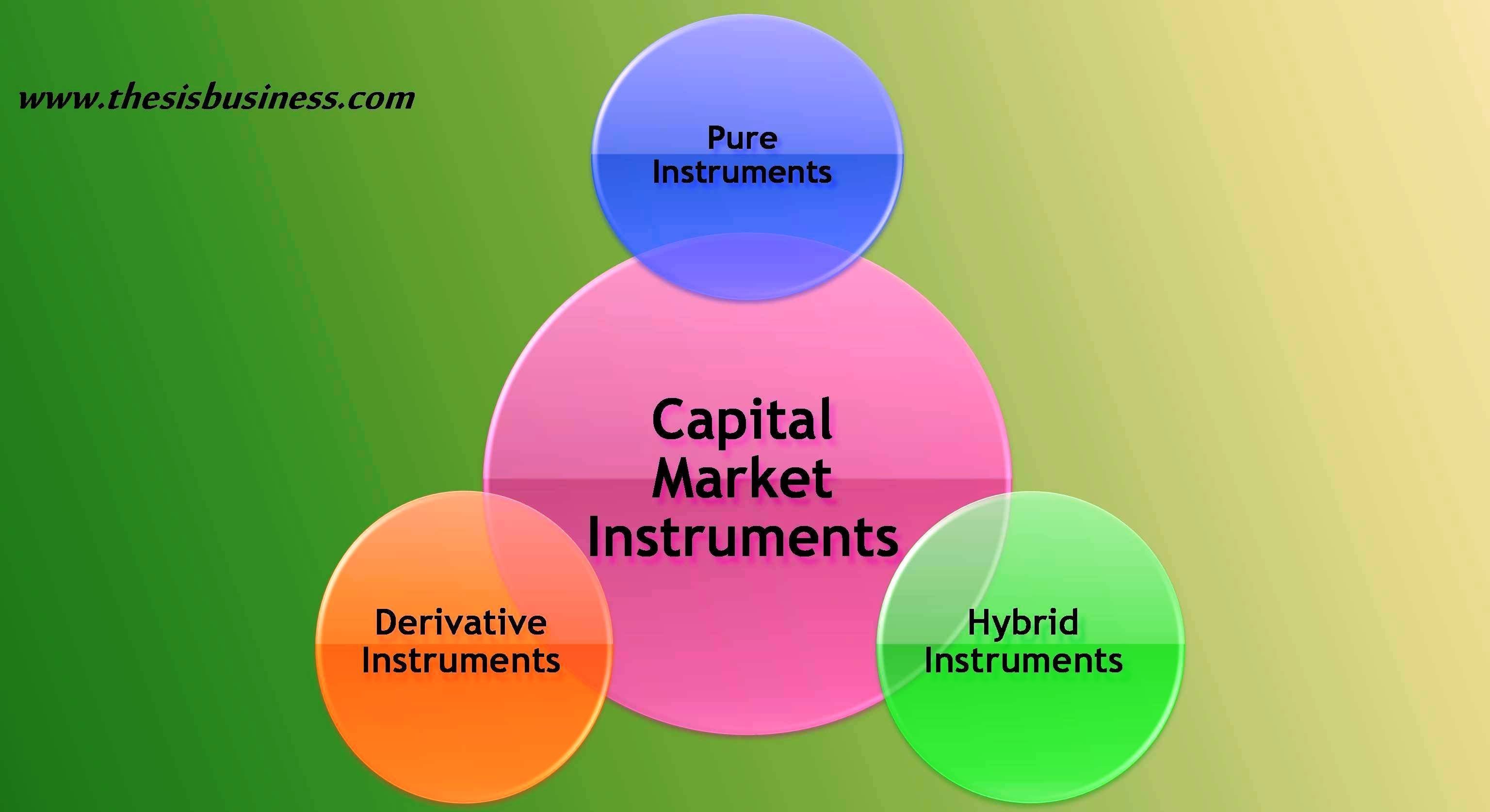

The capital market instruments can be broadly classified into three categories viz

- Pure Instruments

- Hybrid Instruments

- Derivative Instruments

We will discuss all one by one in brief.

Pure instruments are those financial instruments which are created/ issued by the companies or government along with basic features only ie. there is not any enhancement in the characteristics of these instruments are known as Pure Instrument. Some examples of pure instruments are equity shares, preference shares, debentures and bonds.

However, those financial instruments which are formulated by combining the characteristics of equity, preference, debentures and bonds simultaneously are known as Hybrid Instruments. Convertible preferred shares, convertible debentures etc are examples of hybrid instruments.

Derivative instruments refer to those financial instruments which derive its value from other underlying financial instruments or variables. Futures and Options are few examples of derivative instruments.

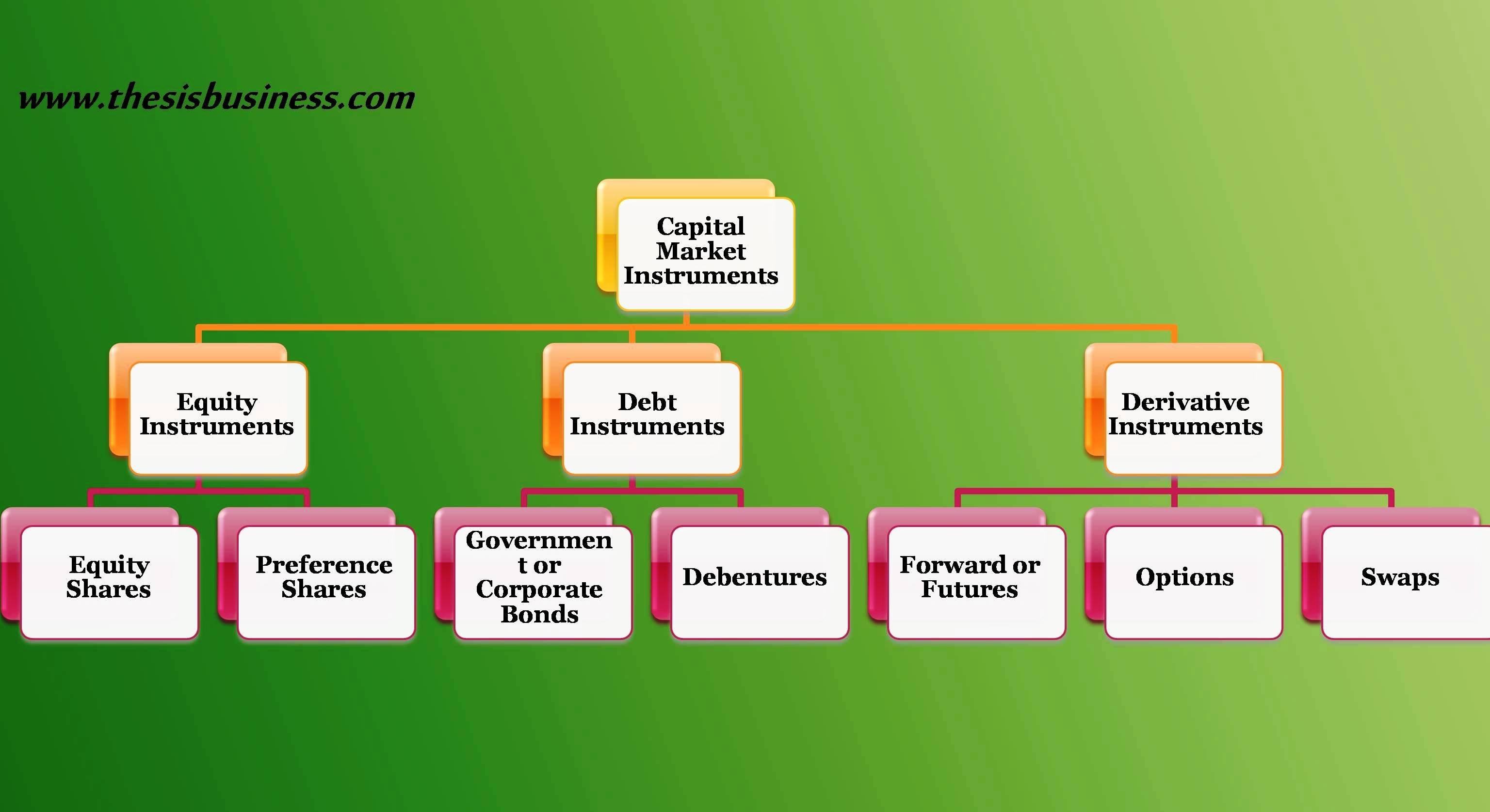

1) Equity Instruments:

The Equity instruments have been the most popular and preferred source of long term finance for businesses and corporations. It mainly contains Equity Shares (or common shares) and Preference shares (Preferred Stocks).

a) Equity Shares:

Equity shares or shares/ stocks also known as common stock or ordinary shares refers to the certain proportion of ownership of the issuing company. The companies issue the shares by diluting their ownership to the general public, in other words, the companies sell their specified percentage of ownership to the public to raise long term capital from the capital market.

The shareholders of the company have rights for voting in the management of the company and entitled to reward dividend periodically (half-yearly or annually), however, it is not mandatory for the companies to declare dividend every year or half-year.

For more details,

Equity Shares | Pros and Cons of Equity Shares

b) Preference Shares:

Preference shares also known as Preferred Stocks are also equity of the company representing ownership of same having preferential rights to receive fixed dividend prior to the common stockholders, however, they don’t have voting rights during important affairs in the company. Moreover, at the time of liquidation, the preference shareholders are given priority over the ordinary shareholders.

There are various types of preference shares offering other special rights lucrative benefits which a company can issue to attract the investors.

For detailed information: Types of Preference Shares

Difference between Equity shares and preference shares

2) Debt Instruments:

Debt instruments refer to the debt/ loans raise by the companies from the public/ investors by selling debt securities in the capital market. It imposes a financial obligation on the issuer after a stipulated period of time. That means the companies who issue debt security will be under obligation to repay the principal amount to the bearer of security on the maturity date, in addition, to pay a fixed rate of interest periodically. Some most popular forms of long term debt securities (Dated securities) are as follows.

a) Corporate or Government Bonds:

Bonds are the most popular debt instruments which a company or government issue to the public to fulfil their long term needs of funds and when it is issued by any government is called Government Bonds whereas if issued by the corporations is called Corporate Bonds.

The Government bonds are known as the most secured debt instruments offering a fixed rate of interest and having a longer maturity period as it is guaranteed by the Government itself hence known Gilt Edged Securities.

b) Debentures:

Debentures are those debt instruments which are typically issued by the companies in order to raise funds from individuals. It also provides a fixed rate of interest and having a medium maturity period less than bonds. Moreover, there are several types of debentures which provide various additional features from the investors as well as issuers’ point of view.

For details read also, Types of Debentures

3) Hybrid Instruments:

When the characteristics of the two securities are combined together to provide additional value and flexibility to the investors, it is called a Hybrid instrument. Convertible Bonds or Debentures and Convertible Preference shares are the best examples of hybrid instruments.

The convertible bonds or debentures have a special feature of convertibility ie. such bonds or debentures can be convertible to equity shares of the underlying company after a certain time period and the bearer can enjoy the benefits of equity share like voting rights and capital gain due to movement in share price, however, if the company underperforms they can suffer a loss as well.

Similarly, convertible preference shares can also convertible to equity shares of the underlying company to enjoy the advantages of common shares.

4) Derivative Instruments:

The derivative instruments are basically utilised to hedge the risk associated with financial security due to price movement of financial instruments in the stock market. However, sometimes investors use it for speculation purpose. It can be classified into two categories viz Exchange-traded and Over the Counter Derivatives.

The exchange-traded derivatives are those instruments which are traded in the stock exchanges, on the other hand, OTC derivatives are those which are traded between two investors individually as per their mutual terms and conditions. Some examples of derivative instruments are as follows.

- Forwards or Futures

- Options

- Swaps

For a detailed explanation, follow the link below.

What are Derivatives? Comprehensive Explanation

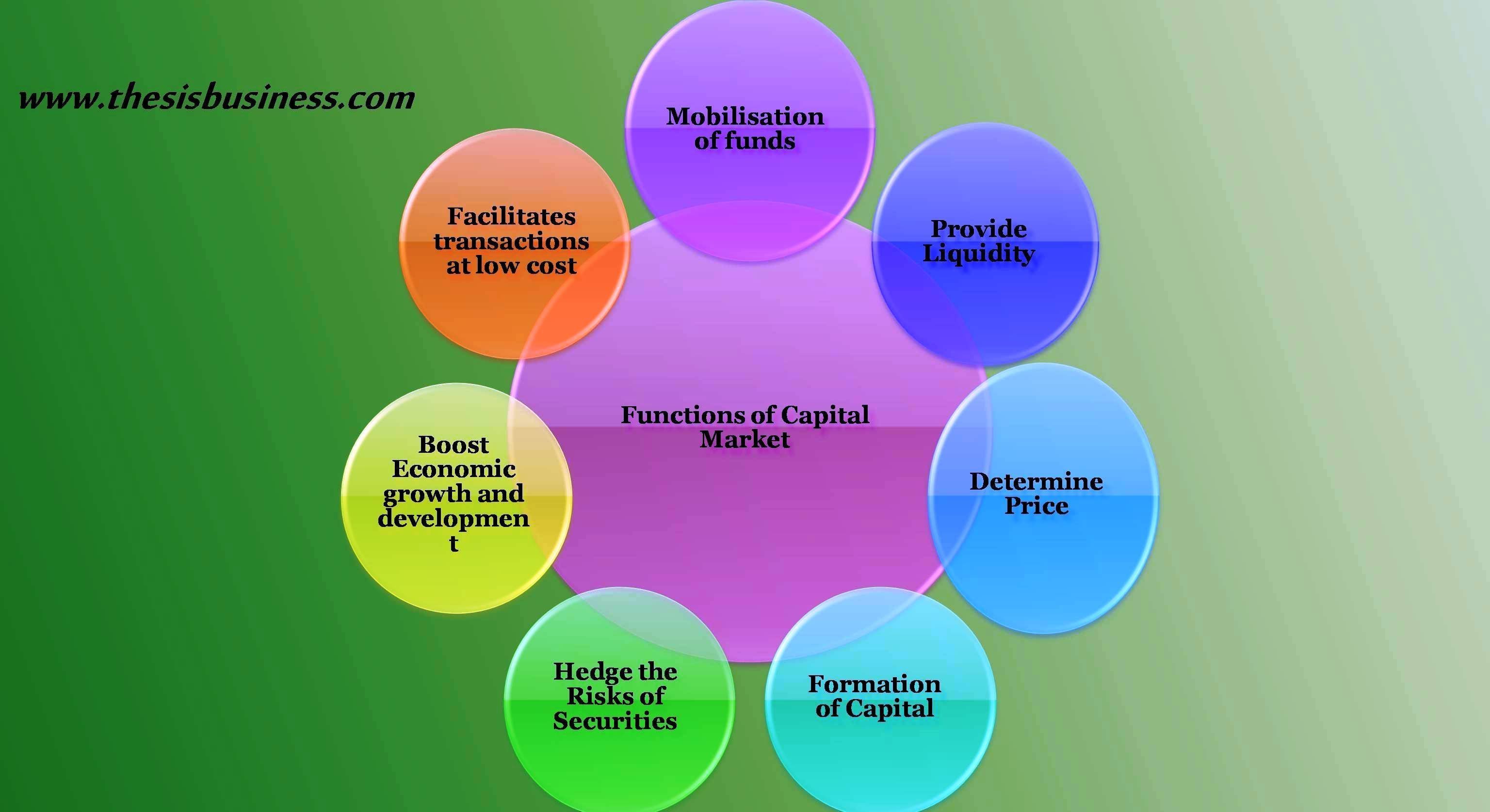

Functions of Capital Market:

The capital market acts as an intermediary between corporations which require funds and the investors who have surplus funds. The money flows from the group with surplus funds to the deficit funds. Some other important functions of the capital market are explained below.

1) Mobilisation of funds:

The capital market provides opportunities to the general public and other financial institutions to mobilise their funds into various financial instruments such as shares, bonds, debentures as per their choice and requirements. There are no limitations on the minimum amount to be invested, anyone who wishes to invest their savings in the capital market/ stock market can park his funds as per his choice. Thus capital market facilitates mobilisation of savings.

2) Provide Liquidity:

Capital market not only provide mobilisation of savings but it provides liquidity as well. The financial securities are listed in the stock exchanges with all the details and can be easily purchased and sold any time among different investors.

The securities are created in the primary market and once it is issued, can be easily sold in the secondary market immediately.

3) Determine Price:

The capital market also determines prices of financial securities according to demand and supply theory. If the demand for any particular securities is high, the price will also increase, on the other hand, when the demand is decline the price of such securities will also decline. Hence the prices of securities are not fixed, it fluctuates and determined by the capital market itself. Thus the capital market also determines prices of issued securities.

4) Formation of Capital:

The capital market encourages the formation of long term capital for businesses, government and other financial institutions and other industries who are looking for capital funds. It spreads the information regarding various lucrative schemes and saving opportunities to individual and institutional investors which results in capital formation.

5) Hedge the Risks of Securities:

As the prices of financial securities are determined in the secondary market (stock market) based on demand and supply, therefore, the prices of securities unstable and fluctuating with respect to time. There are derivative instruments listed in the stock exchanges which provide insurance facility for the security to hedge the risk of loss due to price fluctuation.

6) Boost Economic growth and development:

The capital market arranges long term capital for emerging and established industries, businesses which speed up production and growth of the organisations due to which the rate of unemployment will decrease in the country. The government also raise funds from the capital market for various schemes and infrastructure development which facilitates economic and infrastructure development of the country.

7) Facilitates transactions at low cost:

The capital market facilitates transactions comparatively at a lower cost due to digital and internet. It provides quick news and information about new issues and other important news and reduces advertisement and marketing cost as well.

Conclusion:

Hope this article would be able to explain and understand the concept of the capital market, its instruments and functions. In a nutshell, a capital market is a platform for lenders and borrowers to fulfil their respective needs. It meets the people having surplus money and the people who require funds.

The capital market has two segments, Primary market where the financial instruments are created first time and the secondary market where the existing instruments are bought and sold.

Recommended Articles:

What is Hedging of Securities?

References:

1) Wikipedia

2) investopedia