In cross border trade, there is always a credit risk for both buyer and suppliers because both are unknown to each other and at the same time, different legality/ sets of rules are applicable to different countries.

In this circumstance, Buyer’s Credit plays a vital role during international transactions and facilitates such international deals with negligible chances of default.

In this article, we will understand, what exactly is the buyer’s credit? And how it facilitates the export & import of goods/ services around the globe. Apart from this, we will also discuss, the mechanism of issuing buyer’s credit and how it is settled between buyers and suppliers.

Table of Contents

Buyer’s Credit:

A buyer’s credit refers to a short term credit facility provided by foreign banks/ foreign branches of domestic banks or other financial institutions to facilitate cross border trade between exporter and importer.

In simple words, the buyer’s credit is a type of loan provided by foreign banks in foreign currency and typically, issued at a lower interest rate than other loans which are available locally.

The buyer’s credit is offered by overseas lenders such as banks or other financial institutions to encourage their country’s exports. It is generally issued at cheaper rates as compared to other credit options available to buyers/ importers.

It is designed and regulated in such a way that there are negligible chances of default. That’s why a buyer’s credit is a more powerful and safe instrument while dealing in international trade/ transaction.

Buyer’s Credit (Example):

Let us consider an example to thoroughly understand the concept of buyer’s credit.

Suppose, there are two parties namely,

- Party A (buyer/ importer) from USA

- Party B (seller/ exporter) from China

Now assume A wishes to purchase computer equipment worth USD 1,00,000 from party B. But there is always a risk of default for both parties A and B.

If A makes an upfront payment and B wouldn’t supply the goods, conversely, suppose B supply the goods and if A wouldn’t make payment as per contract.

In this case, the role of the buyer’s Credit comes into the picture. Here, the exporter’s (B) bank sanctions a credit worth USD 1,00,000 against a Letter of Undertaking (LOU) issued by the buyer’s bank. In fact, such issued loan/ credit is known as the buyer’s credit.

Parties involved in Buyer’s Credit:

There are basically, five parties involved whenever a buyer’s credit is issued.

- Buyer/ importer

- Buyer bank/ domestic bank (Also known as Facilitator bank)

- Supplier/ exporter

- Supplier bank/ Foreign bank

- Export Facilitator/ financing Agencies

Buyer’s Credit – Advantages & Disadvantages:

Though the buyer’s credit has a few disadvantages as well. But first, let us know some advantages of utilising a buyer’s credit.

Pros:

1) Low Interest Rate:

Foreign lenders such as banks or other financial institutions usually provide credit comparatively at a lower rate of interest to other loans available locally. They provide loans to importer/ buyer at London interbank Offered Rates (LIBOR) which is economical to the buyer.

2) Secured Payment:

As the buyer’s credit is either guaranteed by the domestic bank or Export Financing Agencies which is typically the Government entities. The exporters don’t need to care regarding their payment.

Apart from this, the banks or other financial institutions issue the Letter of Undertaking (LOU) only after keeping the borrower’s assets (fixed assets) or other securities as collateral. Therefore, it ensures a 100% guarantee of payment to the supplier.

3) Flexible Tenure:

Depending upon the types of commodities, the tenure of repayment varies. For instance, if the buyer imports raw materials to produce finished products, he may get higher tenure for repayment, however, if he purchases tradable goods (ready to sell), he can get a period up to one year for repayment.

If buyer purchase machinery for his plant, he can get even longer period for repayment of loan.

In fact, the time period for repayment entirely depends upon the Cash Operating Cycle of the goods imported. Thus a buyer’s credit provides a flexible time period for repayment according to the buyer’s requirements.

4) On-time Payment:

A buyer’s credit is beneficial for both the importer and exporter. The importer gets credit for his purchase at a cheaper rate, on the other hand, the exporter gets his payment on time as per the sale contract by the lender based in his country.

Therefore, exporters can execute even larger orders without any issue of cash crunch.

In addition, a buyer’s credit also has other features as follows.

- The importer can request the credit in major currencies which is more stable with respect to his domestic currency to avoid the risk of devaluation.

- It can be extended as advance payment to the exporter on behalf of the buyer/ importer.

- It can be transaction-specific or revolving/ renewable basis.

Cons:

A buyer’s credit has some limitations as well when it comes to the financing of purchase capital goods or services internationally.

- Due to the complexity in the process of issuing, it is executed for large order/ purchase only.

- Collateral is required to get a buyer’s credit.

- Some export financing agencies also require a guarantee from the central bank of the importer/ borrower. For instance, EXIM bank (India) require a guarantee from the central bank to issue a buyer’s credit.

- The borrower has to bear the risk of currency devaluation (if any) during the tenure of the loan.

Buyer’s Credit – Process:

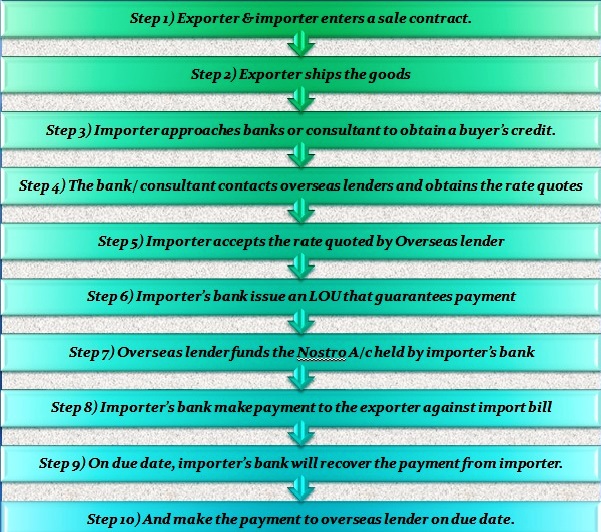

There are several steps involved in a buyer’s credit.

- The first step is the commercial or sale contract between the exporter and importer to import/ purchase specific raw materials/ capital goods or services. The sale agreement specifies the significant details such as details of goods, price, quantity and terms of payment (due date) etc.

- The supplier ships the goods as per the contract and submits the associated documents to the supplier’s bank as per agreed terms & conditions. The supplier’s bank contact to importer’s bank for payment on the due date.

- In between, before the due date importer approaches the local banks or consultants to arrange a buyer’s credit.

- Importer’s bank or consultant approaches overseas lenders to avail the buyer’s credit and overseas lender quotes their rates.

- If the importer accepts the quote, the overseas lender issue a letter of offer for buyers credit, however, some lenders also require a Request letter from the importer.

- The importer’s bank or exporter financing agencies issue a letter of undertaking (LOU), which states a guarantee of payment (principle amount+ interest) to the foreign lender, if the borrower defaults.

- The foreign bank/ lender funds the amount in Nostro Account held by the importer’s bank as instructed in LOU/ LOC.

- The importer’s bank makes payment to the exporter against the import bill to the exporter’s account.

- The importer’s bank will recover the entire amount (principal + interest) from the importer on the due date and remits the same to the overseas bank/ lenders.

- If the borrower defaults, the importer bank will still have to make payment to a foreign bank on the due date according to the LOU. Also, if the payment is guaranteed by the export financing agencies, the payment would be done by the Export Financing Agency itself.

Buyer’s Credit Charges:

There are several charges applicable while availing a buyer’s credit which are borne by the importer himself.

- Interest cost: interest will be payable, typically at LIBOR + BPS from the date of credit to the date of repayment.

- SBLC/ LOU issuance charges depend upon banks to banks.

- Hedging Cost: The hedging cost is borne by the importer due to currency devaluation of domestic currency over the particular time period of the loan. Although importer can hedge the risk of currency devaluation by entering a forward contract.

- Withholding Tax (WTH): Importer has to pay withholding tax over the interest on fund borrowed from the foreign bank.

- Other Charges: Consultant fees, A2 payment on maturity (15CA, 15CB), Agreement fees etc may also apply depending upon case to case.

Conclusion:

Although there are some other instruments to facilitate international trade, yet a buyer’s credit not only encourages the country’s export but it also encourages importer for bulk order without any upfront payment.

Since getting a buyer’s credit is a complicated procedure, hence it is exercised only for large orders. Nevertheless, it is the most popular method of trade credit globally.

Hope this article would be able to clear all the significant information regarding a buyer’s credit.